Make your retirement plans tick while you focus on your business.

An innovative retirement solution that streamlines plan operations, enhances sponsor satisfaction, improves participant outcomes and frees up everyone’s time.

Make your retirement plans tick while you focus on your business.

An innovative retirement solution that streamlines plan operations, enhances sponsor satisfaction, improves participant outcomes and frees up everyone’s time.

Make your retirement plans tick while you focus on your business.

An innovative retirement solution that streamlines plan operations, enhances sponsor satisfaction, improves participant outcomes and frees up everyone’s time.

Reduce Operational Burden

Outsourced plan and investment fiduciary services that reduce operational burden and limit liability for advisors and plan sponsors.

Concierge Service

We deliver the experience to help drive outcomes for advisors and sponsors.

Improved participant outcomes

We provide intelligent defaults and low-cost, personalized managed accounts

As an industry, we’ve made it complex and challenging to deliver a top-notch retirement plan to your customers —and those challenges seem to compound each and every year. Meeting all your clients’ needs can become daunting, often leaving little time or energy to focus on expanding your business.

Fortunately, there’s a solution: partnering with the experts. WorkSaveRetire is a comprehensive service package that takes all of the critical administrative tasks required to offer a retirement plan and places them on our shoulders.

Your Retirement Team

Rather than throwing tools at business owners and employees, hoping they make the most of them, we assume the responsibility and liability of offering a plan on their behalf.

You

- Selection and oversight of American Trust

- Client consulting

- Personalized employee services

- Cultivate individual wealth opportunities

Your Client

- Submit payroll each pay period

- Approve year end data

- Monitor American Trust

The American Trust Team

- Signs on as named plan administrator and fiduciary at both the plan as a whole and its investments

- Administers the plan as a fiduciary

- Approves all participant distributions

- Manages the plan’s investments

- Delivers participant notices

- Completes required annual reporting

- Benchmarks plan fees

Why Choose American Trust’s WorkSaveRetire?

Scales Your Retirement Business

- Partnering with American Trust Retirement enables you to create a scalable model where you spend more time nurturing client relationships and growing your business while we handle all plan activities.

- Leveraging our more than 50 years in the retirement space serving countless retirement plans, WorkSaveRetire addresses the most common refrain we’ve heard loud and clear from clients: “Make it simple for me to offer a retirement plan that helps plan participants achieve the retirement they want.”

Reduces Fiduciary Risk

- Your plan sponsors may have a general understanding of their fiduciary responsibilities, but they likely underestimate the personal risks and obligations that come with acting as a fiduciary of a retirement plan. WorkSaveRetire mitigates much of the fiduciary risk they assume.

Supports Your Clients’ Success

- With American Trust managing the administrative tasks involved with offering a retirement plan, your clients can focus on what matters most, running a successful business.

Delivers Better Outcomes

- A participant’s success depends on various factors, such as contribution levels, investment choices and market conditions.

- By combining smart plan design features with a focus on participant advice, we take the guess work out of the equation and position plan participants to achieve their long-term goals. Adjustments to plan operations will be made automatically when we see opportunities to improve plan performance.

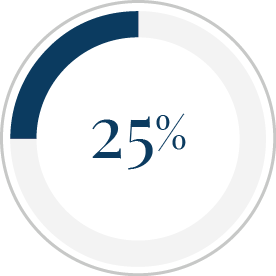

Participant success prior to adopting the

WorkSaveRetire formula.

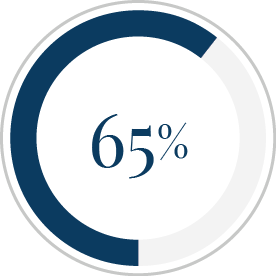

Participant success with WorkSaveRetire’s

intelligent defaults and personalized managed accounts.

Let our expertise

work for you.

Contact us at [email protected]