Cash Balance Plans: A Strategic Advantage for Advisors

At American Trust Retirement, we work behind the scenes so you can shine in front of your clients. We deliver strategies that go far beyond a standard 401(k).

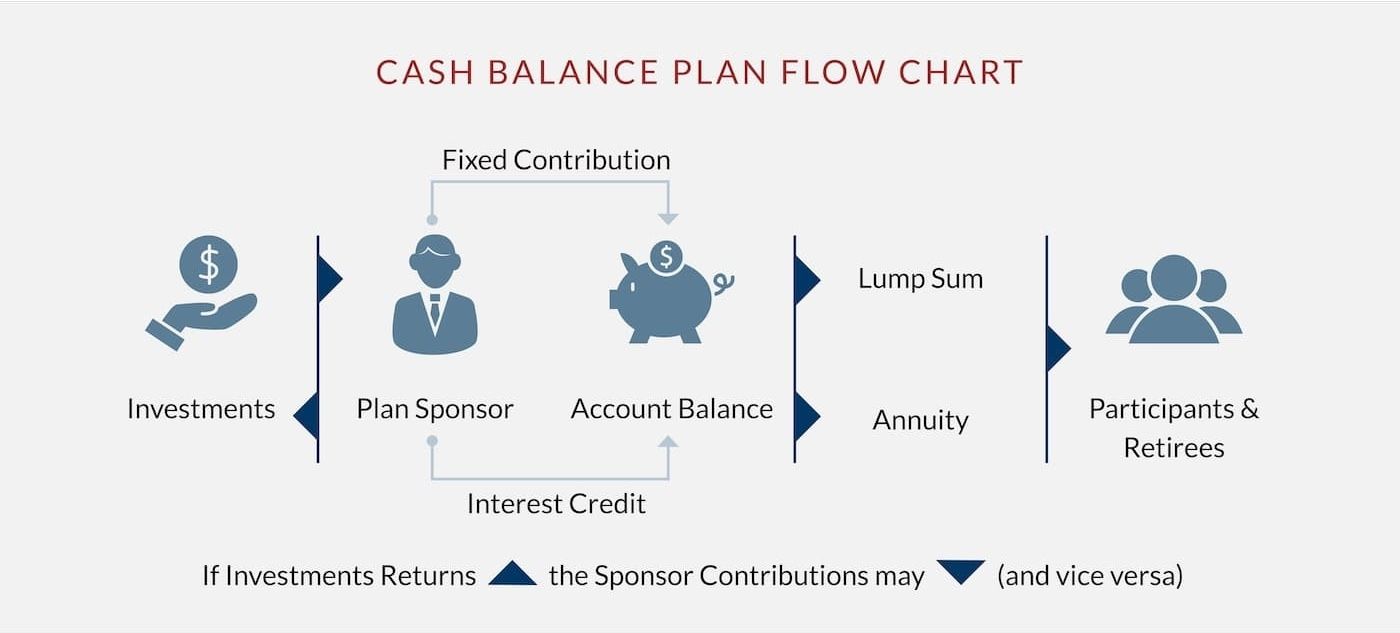

How a Cash Balance Plan Works

Hypothetical Account Strcture

Each participant has a notional account that grows annually through employer contributions and interest credits. Balances are unaffected by market volatility.

Retirement Benefit Options

Balances can be converted into monthly lifetime income or taken as a lump sum, which can be taxable or rolled into another qualified plan or IRA.

Pooled Investments

The employer or appointed investment manager controls the investments. While returns do not affect participant balances, they can influence future employer contributions.

Is a Cash Balance Plan Right for Your Client?

- Do they currently sponsor a 401(k) or other retirement plan?

- Do they want to contribute more than profit-sharing limits allow?

- Does their business have consistent cash flow?

- Can they commit to larger contributions for at least three to five years?

- Are they willing to contribute up to 7.5% of employee pay to unlock bigger deductions?

If most answers are “yes,” your client could be an ideal candidate. The growing adoption of these plans is no accident. Learn more about industry trends in The Rise in Popularity of Cash Balance Plans.

Top Five Client Profiles for Cash Balance Plans

- Highly profitable companies seeking large deductions

- Family businesses and closely held businesses with multiple owners

- Law firms, Medical Groups, and Dental Groups that value tax deferral and asset protection

- Professional firms: CPAs, engineers, architects, consultants

- Sole proprietors earning $260,000+ annually looking to maximize tax benefits

Why Advisors Choose Cash Balance Plans

Deliver More Value

Enable clients to contribute significantly more—often hundreds of thousands annually.

Maximize Tax Efficiency

Offer large, tax-deductible contributions that can drastically lower taxable income.

Differentiate Your Practice

Stand out by offering advanced planning options few advisors tap into.

Support Business Owner Clients

Position Cash Balance Plans as a powerful recruitment and retention tool.

Cash Balance Plan Contribution Potential for Advisors

Many advisors pair a cash balance plan with a traditional 401(k) profit-sharing plan to achieve even greater contributions. When tested together for compliance, the right demographics can produce significantly larger owner contributions while keeping staff costs modest.

Real-World Example: Potential Contributions

Partner With American Trust Retirement

We make it simple for advisors to integrate Cash Balance Plans into their client offerings. Our services include:

- Custom plan design aligned to client objectives

- Full administration and compliance

- Investment management support

- Clear, participant-friendly communication

If your clients are looking to keep more of what they earn and save more for retirement, a Cash Balance Plan could be their answer and your competitive advantage

Cash Balance FAQs for Advisors

How do I position this with my clients?

Focus on tax savings, high contribution limits and pairing with a 401(k) for maximum effect.

Can clients pause contributions?

These are intended as permanent plans, but they can be frozen in certain circumstances.

How long should a plan be in place before termination?

The IRS generally does not challenge permanency if the plan lasts at least five years.